Common Misconceptions About Mortgage Broker Licensing

AlexJones

- 0

- 668

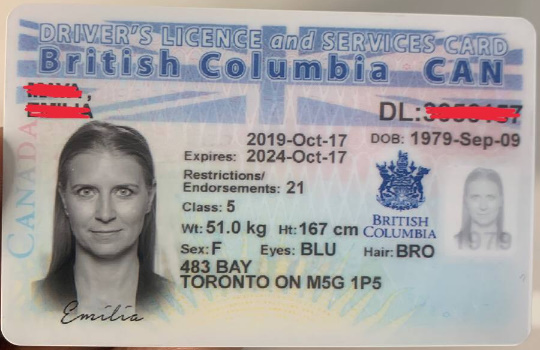

The Mortgage Business is all about closing a loan as fast as possible with the best rate possible, while making the borrower happy through the whole process. Since one of the most important things in the business is speed, I understand when mortgage companies want to look for shortcuts to getting BRITISH COLUMBIA FAKE DRIVERS LICENCE as a mortgage broker in other states, but there is just so such thing. Here are a few misconceptions and examples of what you can do to make the process of mortgage broker licensing as smooth and quick as possible.

I speak to people weekly that think that if they have a license in their home state, they can originate loans on properties in any other state. Unfortunately, this is untrue. Every state has their own licensing requirements that govern what type of license is required to originate loans on properties in their state. For mortgage brokers, usually you have to license the company (Corporation or LLC), each location of the company that originates mortgage loans (branches), and each individual that originates mortgage loans (LOs or Loan Originators). Holding these types of licenses in your home state only allows you to originate loans on properties located in that state.

It would great if there was a single license you could get to allow you or your company to originate loans throughout the United States, but our US Constitution sets state rights that allow each state to regulate industry in their own state. That is why we have different licensing requirements for each state.

Often people think of a surety bond as an insurance policy and assume that it will cover any state they want to get licensed in. A surety bond, however, is actually not an insurance policy to cover your company, but a bond to protect the consumer and third parties that your company work with. The bond lists the state regulatory agency as the entity that has the right to make claims on the bond. Therefore, each state requires their own bond that protects consumers in their state. Unfortunately, this means that if you want to get licensed in all 50 states, you may have to get up to $2 Million in Surety Bond. Most companies simply can’t get approved for this many bonds since the liability is so high. Thus, surety bonds often restrict smaller companies from getting licensed in too many states.

I hear this a few times a year. Someone wants to get into the mortgage business as quick as possible and assumes that purchasing an currently licensed mortgage broker will allow them to avoid the time an hassle of getting the licenses themselves.

The first thing to keep in mind is that the licenses are tied to the company’s tax ID. This means that if you purchase a mortgage company, you cannot just dissolve it and take the licenses. You have to keep that entity fully intact. When you buy the company, you don’t just buy the licenses, but you buy all the liabilities. Major liabilities include debt such as unpaid bills, but also they include all of the closed loans for the company over the last 3 to 5 years. All of those loans are now a liability. A lender could force a buyback or a state could audit the files and force a refund to the borrowers or a fine. This could get very costly if the loans were not good loans. Even if they were already sold or just brokered originally.

The second thing is that each state requires about just as much paperwork to do a change in ownership as they require to get a new license. All new owners and officers have to provide paperwork. Also, there are some states that will require you to apply for a whole new license.

My recommendation, when it comes to mortgage broker licensing, is to take it one step at a time and devote time to doing it right. If you try to rush through it and take shortcuts, or if you don’t give it your full attention, you will find yourself unlicensed and unable to do business. Take it seriously, fill the paperwork out correctly, ask questions, and follow up with the states, and you will find that it becomes simple to maintain once you hold the licenses. Then you will be able to succeed and grow your mortgage business.